Adam Smith and David Ricardo made a very powerful case against mercantilism, Ricardo going so far as to do a mathematical proof. Yet mercantilist China is fast becoming the world’s economic superpower. Free trade U.S. is in danger of becoming a has been power.

Yes, one can blame overregulation, deficit spending, and perhaps vulture capitalism for U.S. relative declines. And even though the balance sheet is looking bad, and U.S. employment numbers stink, it is also true that U.S. (and First World in general) workers benefit from being able to purchase cheap goods from rising powers like China.

Still, theory and results seem a bit at odds. How does the Law of Comparative Advantage work when applied to a country which has a welfare system, a minimum wage, and workplace safety regulations? How about when one country subsidizes an export? Which is closer to the free trade optimum: one country subsidizing an export with not response, or the importer imposing a tax equal to the subsidy?

And even if tariffs are still destructive, how do revenue tariffs compare with other taxes? All taxes have a price.

I don’t claim to have the answers to these questions. I suspect there are some economists out there who have redone Ricardo’s proof with some of these complications added. If so, I’d be interested in some references. In the meantime, I have become considerably more sympathetic to the protectionists and anti-globalization advocates than I was when I first wrote the Quiz.

So, an attempt at a more balanced question (to replace the old Subsidies question).

FREE TRADE

The classical economists Adam Smith and David Ricardo made compelling cases for free trade. Specialization and comparative advantage benefit all trading partners. But did their proofs take into account the modern welfare state, minimum wages and pollution regulations? Are first world nations such as the U.S. giving away their seed corn to rising mercantilist powers such as China, while hurting their working classes in the bargain? Then again, what of the complexity, corruption and crony capitalism which arises when the government tries to offset foreign export subsidies with retaliatory tariffs, counter subsidies, etc.?

What should the U.S. trade policy be?

- Continue as currently, more or less.

- Get rid of all tariffs, quotas, and export subsidies.

- Aggressively enforce existing trade laws, retaliating against foreign subsidies which hurt domestic industries.

- Increase tariffs and/or pull out of some/all of our trade agreements.

- Implement an all out industrial policy.

- Get rid of the existing reams of tariff schedules and trade agreements, but tax imports implicitly by having a national sales tax. This sales tax could replace Social Security taxes, the federal income tax, or both.

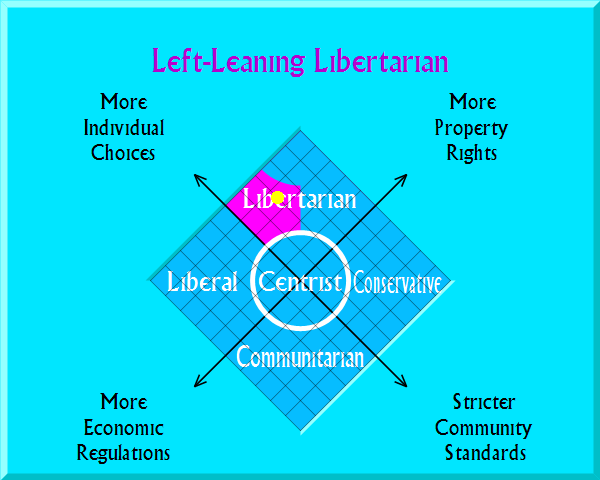

Hmmm, not as many options as I have for some V7 questions, but perhaps this is a good thing. Note that I do not go from most authoritarian to least or vice versa. The last answer is probably the most libertarian, yet if follows the most authoritarian. Confusing?